Pnb Bank Interest Rates

Address: Philippine National Bank Financial Center Pres. Diosdado Macapagal Boulevard, Pasay City, Philippines 1300 Trunkline: (632) 8526-3131 to 70 8891-6040 to 70 E-mail: customercare@pnb.com.ph. PNB medium-term fixed deposits offer a rate of interest ranging from 4.50% p.a. To 5.30 percent per annum for anytime between 1 and 5 years. For 1-year deposits, the PNB FD interest rate is 5.25.

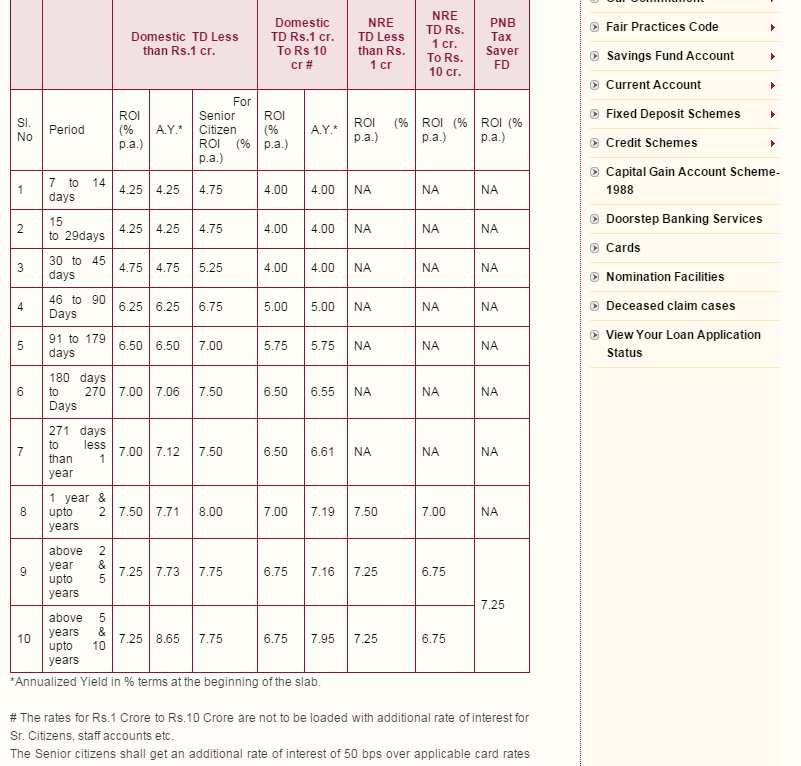

In case the interest earned by users across all their RD accounts across all PNB branches in a year exceeds INR 10, 000, the bank must deduct TDS at 10.3 percent. If a user's IT PAN is not updated in. Punjab National Bank (PNB) FD Rates 2021 Updated on February 11, 2021, 12130 views. Punjab National Bank (PNB) offers competitive Fixed Deposit interest rates and a wide range of other benefits such as. Pacific National Bank test. This slideshow displays one of three total slides. Left/right arrow keys, or swipe. Download our 'PNB Mobile Banking' App today and enjoy banking with us anytime, anywhere. Work hard.worry less! Our Business Cash Management Services can help you. We offer short term and long term fixed rate.

Discover Bank Interest Rates

PNB-Verify is a device binding solution for Retail Internet Banking users, by which user can authenticate transaction using Mobile Application through App notification instead of using the SMS based OTP, as second factor of authentication. To enroll for PNB Verify navigate as: Personal Settings -> Enroll for PNB Verify

PIHU (PNB’s Instant Help for yoU) - responds to customer queries (FAQs) related to Retail Internet Banking, Mobile Banking and Debit Card.

Now you may apply for Sovereign Gold Bond through Retail IBS by using the navigation: Other Services-> Sovereign Gold Bond -> Purchase SGB.

Now you may link your GSTIN through IBS by using the navigation: Other Services-> Register for Govt. Initiatives-> GSTIN Registration.

Get your PAN linked with your account through IBS by using the navigation: Other Services-> Register for Govt. Initiatives-> PAN Registration

To Prevent Fraudulent Payment of Cheques in your Accounts, Please Avail PNB Suraksha Scheme

Link Demat Account With Your IBS User ID and Get Details Of Holding in the Demat account in the Statement of Transaction

Please Download latest version of PNB UPI from Play Store to Enjoy Enhanced Features.

What's New

Druk PNB Bank is pleased to announce the revised lending rates based on Minimum Lending Rate (MLR) with effect from 07.04.2017, in accordance with the regulations issued by Royal Monetary Authority as under

Sl. | Loan Products | Tenor | Existing Rates (p.a) | Revised Rates (pa) | ||||||

| Years | Floating | Semi-Fixed | Fixed | Floating | Semi-Fixed | Fixed | ||||

| 6 Months | 3 Years-Reset | Entire Tenor | 12 Months | 3 Years Rests | Review after 5 Years | |||||

1 | AGRICULTURE | 5 | 10% | – | 13% | 10% | – | 11% | ||

I | EDP/CGS | 5 | 10% | – | 12% | 10% | 10% | 10% | ||

ii | Working Capital | 1 | – | – | – | 10.50% | – | – | ||

2 | PRODUCTION & MANUFACTURING | 15 | 11.25% | 12% | 13% | |||||

I | Manufacturing Enterprises | 15 | – | – | – | 11% | 11.50% | 12% | ||

Ii | Mining & Quarrying | 15 | – | – | – | 11.25% | 12.00% | 12.50% | ||

Iii | Handicrafts & Textile Production | 15 | – | – | – | 10.50% | 10.75% | 11% | ||

Iv | Wood Based Products | 15 | – | – | – | 10.50% | 10.75% | 11% | ||

V | Others EDP | 5 | 10% | – | 12% | 10% | 10% | 10% | ||

Vi | EPC | 1 | 11% | – | 13% | 11% | – | – | ||

Vii | Working Capital | 1 | – | – | – | 11.25% | – | – | ||

Viii | Others(Transport) | 5 (15) | – | – | – | 11% | 11.50% | 12% | ||

3 | SERVICES | 20 | 11% | 11.50% | 13% | |||||

I | Tourism | 20 | – | – | – | 10% | 10.50% | 11% | ||

Ii | Hotels & Restaurants | 20 | – | – | – | 10.50% | 10.75% | 11% | ||

Iii | ICT | 20 | – | – | – | 10.50% | 10.75% | 11% | ||

Iv | Consultancy Services | 20 | – | – | – | 10% | 10.50% | 11% | ||

V | Hospitality, Entertainment & Recreational Services | 20 | – | – | – | 10.50% | 10.75% | 11.00% | ||

Vi | Institutional/Educational Services | 20 | – | – | – | 11% | 11.50% | 12% | ||

Vii | Health Services & Traditional Medicines | 20 | – | – | – | 11% | 11.50% | 12.% | ||

Viii | Contract (non-construction) | 3 | 12% | – | 14% | 11% | – | – | ||

Ix | Contract (Construction) | 3 | – | – | – | 12% | – | – | ||

X | EDP/CGS | 5 | 10% | – | 12% | 10% | 10% | 10% | ||

Xi | Working Capital | 1 | – | – | – | 11.50% | – | – | ||

Xii | Others | 15 | – | – | – | 11.50% | – | – | ||

4 | TRADE & COMMERCE | 1 | 12.50% | – | 13% | – | – | |||

I | Retail | 1 | – | – | – | 11.50% | – | – | ||

Ii | Wholesale | 1 | – | – | – | 11.50% | – | – | ||

Iii | EPC | 1 | 13% | – | 13% | 11% | – | – | ||

Iv | Overdraft against Immovable Property. | 1 | – | – | – | 11.50% | – | – | ||

V | Others | 1 | – | – | – | 12.50% | – | – | ||

5 | HOUSING | – | – | – | – | – | – | |||

I | Home Loans | 20 | 10.25% | 10.50% | 13% | 9.75% | 10% | 11% | ||

Ii | Commercial Loans | 20 | 10.50% | 11% | 13% | 10% | 10.25% | 11.25% | ||

6 | TRANSPORT | – | – | – | – | – | – | |||

I | Heavy-Commercial | 5 | 11% | – | 13% | 11% | – | – | ||

Ii | Earth Moving Machinery/Equipments-(Commercial) | 5 | – | – | – | 11% | – | – | ||

Iii | Light (Commercial) | 5 | – | – | – | 11% | – | – | ||

Iv | Salary based to GE (Non-Commercial) | 5 | 9.75% | – | 13.00% | 9.75% | – | – | ||

V | Private & Others (Non-Commercial) | 5 | 10.25% | – | 13.00% | 10.25% | – | – | ||

Vi | Working Capital | 1 | – | – | – | 11% | – | – | ||

7 | PERSONAL | – | – | – | ||||||

I | Mortgage loan | 5 | 11% | 12% | 13% | 11% | – | – | ||

Ii | Consumer loan (salary based) | 5 | 9.50% | – | 13% | 9.50% | – | – | ||

Iii | Others | 5 | 14% | – | 15% | 14% | – | – | ||

8 | EDUCATION | 5 | 11.50% | – | 13% | 11.50% | – | – | ||

9 | LOANS TO CORPORATIONS | |||||||||

I | Government Owned/Guaranteed ( > 50%) | 5 | – | – | – | 9% | – | – | ||

Ii | Government Owned/Guaranteed ( = or < 50% to 25%) | 5 | – | – | – | 10% | – | – | ||

10 | LOAN TO FINANCIAL INSTITUTIONS | 3 | – | – | – | |||||

I | Banks | 3 | – | – | – | 9% | – | – | ||

Ii | Non-Banks | 3 | – | – | – | 10% | – | – | ||

Iii | Working Capital (for I &ii) | 1 | – | – | – | 10% | – | – | ||

11 | OTHERS | |||||||||

I | Purchase Shares/Securities | 10 | 11% | 12% | 13% | 11% | 11.50% | 12% | ||

Ii | Against Shares/Securities | 10 | 11% | 12% | 13% | 11% | 11.50% | 12% | ||

Iii | Overdraft | 1 | 11% | |||||||

Ally Bank Interest Rate

With the revision of the above rates reduced from 0.25% p.a. to 0.75% p.a on an average reduction of 0.50% p.a, will impact bank’s interest income for next 12 months by Nu.20.34 million. All other earlier terms remain same.