Suntrust Cd Rates

SunTrust Bank is one of the respectable banks with total assets of $170.8 billon on March 31, 2011. The services that SunTrust Bank provides are vast but include: deposit, credit, trust, and investment. They also specialize in mortgage banking, brokerage, investment management, equipment leasing, and investment banking services. With all the services SunTrust provides, one can see how this bank continues to be growing in this questionable economy.

SunTrust also serves clients in selected markets nationally and vigorously enhances the lives of their clients, communities, colleagues, and their shareholders. SunTrust offers 1,665 retail branches and 2,924 ATMs which are located primarily in Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia, and the District of Columbia. They also have superior online services and offer 24-hour customer services centers.

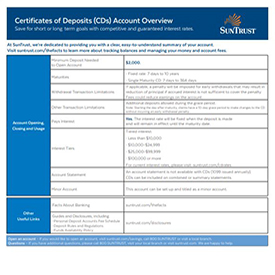

SunTrust Bank offers two CDs: Personal and Advantage. Personal CDs require a $2,000 minimum deposit and offer tiered interest, with terms ranging from seven days to 10 years to fit your needs. SunTrust also offers a 12-month special rate which is comparable to other banks. The remainder of its CD interest rates are slightly below average. Certificates of Deposits (CDs) Account Overview. Save for short or long term goals with competitive and guaranteed interest rates. At SunTrust, we’re dedicated to providing you with a clear, easy-to-understand summary of your account.

Review: SunTrust Bank Services

Credit Card Services: The credit cards provided by SunTrust are highly recognized because they are accepted at more than 21 million merchants and offer amazing awards. Roadside Dispatch is included with all the credit cards and a built-in option to make contactless purchases, which is perfect for avid iPhone users. The SunTrust Platinum Visa® with SunTrust rewards combines the two other credit cards they have to offer.

Checking Accounts: SunTrust has an easy option for you to decide which account is best for your lifestyle and financial needs. On their website, they provide recommendations once you select the different options that you need. Simple and easy to understand descriptions are provided for each account so that you spend less time researching and more time finding the right account for you. The most basic checking account they offer is called Everyday Checking which requires a $100 minimum opening balance and only a $500 minimum daily collected balance to avoid the monthly maintenance fee of $7.

[tab:CDs]

If you need to place your funds in a secure place, then no look no further because SunTrust Bank can help fulfill this need. You can invest your funds for a given amount of time at a fixed interest rate so that you do not need to worry about any interest rate fluctuations that may occur. SunTrust Bank offers CDs ranging from seven days to 10 years. Their philosophy is “the more money you put into your CD, the more you’ll get out of it.”

The minimum opening balance to open a CD is $2,000 and the maximum opening deposit is $1,000,000.00 per CD.

SunTrust Bank – Special CD Package – as of 7/18/11

- 44 month CD & IRA CD and 64 month CD & IRA CD – 2.10% APY

SunTrust Bank – Special CD Offers – as of 7/18/11

- 9 month CD – 0.30% APY

- 15 month CD & IRA CD – 0.50% APY

- 25 month CD & IRA CD – 0.75% APY

- 37 month CD & IRA CD – 1.25% APY

- 59 month CD & IRA CD – 2.25% APY

For more information, or to open an account, please speak with a SunTrust representative at 800.279.4824.

Terms & Conditions: To qualify for the Special CD Package, balances must be split evenly between CDs in the package. A SunTrust checking account is required. A penalty is imposed for early withdrawals.

[tab:Savings Accounts]

Two savings accounts are offered bySunTrust which can help with savings goals while earning interest. SunTrust realizes how hard it is becoming to save and rewards its faithful customers with a bonus into theirsavings account. They offer many techniques to help track every dollar you are spending so that you can meet your savings goal.

SunTrust Bank – Personal Savings Account: Features & Benefits

- Avoid a $4.00 monthly maintenance fee with a monthly automatic transfer from checking of just $5.00 or a low $300.00 minimum balance

- No monthly maintenance fee for minor account owners

- Competitive interest rates

- The ability to deposit or withdraw funds at any time

- Access to your funds through more than 2,800 SunTrust ATMs

- Limit of 2 withdrawals per calendar month unless you are on a combined statement, in which case you are limited to 2 withdrawals per combined monthly statement cycle.

- $4.00 per withdrawal over 2 per month, waived with Minimum Daily Collected Balance of $2,500 or more

- Security of FDIC insurance coverage

- Quarterly statements of account earnings

- Monthly statements if you have any electronic funds transfer activity or if your account is combined with checking

- Daily compounded interest (based on your collected balance, and credited to your account quarterly)

SunTrust Bank – Live Solid Savings: Features & Benefits

- A competitive interest rate

- A one time bonus

- Low minimum opening balance requirement of $100

- No monthly maintenance fee when you set up automatic transfers for as little as $25 a month from your SunTrust checking account, OR maintain a $1,000 minimum balance

- Available combined statements – savings and checking on one easy-to-read statement

- Peace of mind with available overdraft protection for your SunTrust checking account

- An excessive withdrawal fee of $4 is assessed if more than two

- pre–authorized, telephone funds transfers or third party transactions are paid during the month. The fee will be waived for accounts that maintain a minimum balance of $2,500 each month.

- No overdraft protection transfer fee when Live Solid Savings is the protector account.

[tab:Money Market]

SunTrust Bank is offering a money market account exclusively to their personal checking clients. One if its amazing features is the ability to earn competitive rates of interest while still being FDIC secured. You are able to access your money anytime/anywhere and there is no minimum withdrawal amount.

The requirements and basic information to qualify for this account are as follows:

- An open SunTrust personal checking account

- $100 minimum opening deposit

- $5,000 minimum daily collected balance

- No monthly maintenance fee if balance requirement is maintained or $15/month if not maintained

- $15 excessive withdrawal fee (over 6 per statement period)

- Check Safekeeping is a required feature of this product.

- Interest is calculated and compounded daily on the collected balance and credited to your account monthly.

SunTrust Bank Advantage Money Market Account – Opened Online – as of 7/29/11

The interest rate earned on their money market account is based on the following ledger balance tiers:

- Tier 1-$2,499.99 or less

- Tier 2- $2,500 to $9,999.99

- Tier 3-$10,000 to $24,999.99

- Tier 4-$25,000 to $49,999.99

- Tier 5-$50,000 to $99,999.99

- Tier 6-$100,000 to $249,999.99

- Tier 7-$250,000 to $499,999.99

- Tier 8-$500,000 to $999,999.99

- Tier 9- $1 million or more

[tab:Mortgages]

SunTrust Bank is one of the leading innovative banks to offer managed properties for sale available for easy viewing on their website. Support is readily accessible and is SunTrust’s main concern. They offer many educational resources to make sure you are fully aware of the different kinds of mortgage loans offered by various banks.

The rates below are indications for 60 day lock-ins on single family, owner-occupied properties with a loan to value ratio of 80% or less, for applications filed using the Online Loan Application.

Suntrust Cd Rates 32159

To see examples of monthly payment terms, view SunTrust’s APR Examples.

SunTrust Bank – Fixed-Rate Mortgage Loans – as of 7/29/11

- 30 yr Fixed Conventional – 4.375% Interest Rate – 0.000 Discount Points – 4.490% APR

- 30 yr Jumbo Fixed – 4.875% Interest Rate – 0.250 Discount Points – 5.009% APR

- 30 yr FHA – Fixed – 4.250% Interest Rate – -0.375 Discount Points – 4.850% APR

- 15 yr Fixed Conventional – 3.750% Interest Rate – -0.500 Discount Points – 3.871% APR

Suntrust Cd Rates 2020

SunTrust Bank – Adjustable Mortgage Rates – as of 7/29/11

- Agency 5/1 ARM 30 yr – 2.875% Interest Rate – 0.250 Discount Points – 2.580% APR

- Agency 7/1 ARM 30 yr – 3.250% Interest Rate – 0.125 Discount Points – 2.817% APR

Terms & Conditions:Rates, points and closing costs may vary based on loan features, geography and/or other terms and conditions. Rates, points and closing costs are subject to change without notice. Additional rate and point quotes are available; please contact your loan officer for more information.

Suntrust Cd Rates 2019

[tab:END]